Arranging suitable insurance for your campervan or van is a legal requirement, but what's the difference between each type of cover?

Before you hit the road, we're going to explain the key features of campervan and van insurance so you can make a choice that suits you.

What are the main differences between campervan insurance and van insurance?

In terms of cover, campervan and van insurance aren’t quite the same. Here, we’ll break down the differences between the two types of policy.

Van insurance

As they can be classed as commercial vehicles, many providers offer coverage based on the fact that vans often do more miles than campervans, which may increase the cost.

Van insurance policies don't usually provide cover for internal fixtures and fittings. However, some providers can offer cover for personal belongings (excluding tools) and replacement locks.

Campervan insurance

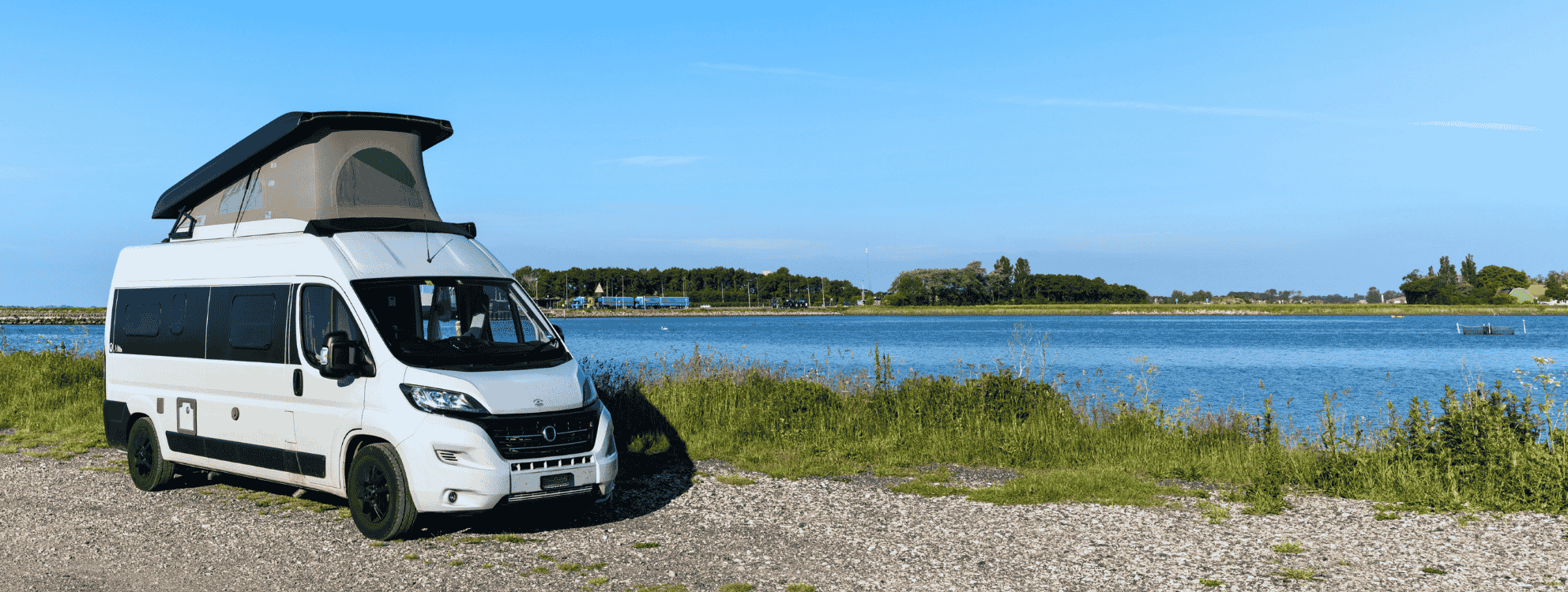

Campervans are classed as leisure vehicles, which means they’re typically used less than commercial vans. With less chance of the policyholder needing to make a claim, campervan insurance can be cheaper than van insurance.

Many campervan insurance policies can also provide cover for personal belongings, camping equipment, and internal appliances such as ovens or beds. Sometimes, providers also offer European Union (EU) travel cover.

Are there any similarities in insurance for vans and campervans?

Whether you have a campervan or a van, you're required to secure suitable third-party insurance to ensure your vehicle is road legal.

Both types of insurance offer third party only, third party, fire, and theft, and fully comprehensive policy options.

The general factors that influence campervan and van insurance premiums are also similar, which we’ll cover next.

Is campervan insurance cheaper than van insurance?

In many cases, campervan insurance can be cheaper than van insurance because many providers class campers as leisure vehicles.

Typically, fewer miles mean less risk, which can result in lower premiums. However, whether you own a van or a campervan, the cost of your policy will depend on factors including:

● Driver age

● Vehicle location

● Annual mileage

● Previous claims history

● Your level van or campervan security

Can I insure my campervan as a van?

Taking out van insurance for a campervan isn't usually recommended as it may not provide adequate cover for personal belongings, internal fittings and fixtures or offer discounts for lower-than-average annual mileage.

If you’re a campervan owner, arranging specialist insurance designed specifically to protect your vehicle and belongings during leisure trips should be considered.

How do I insure a campervan conversion?

Insuring a campervan conversion can be challenging because your vehicle may change classifications during different stages of the process.

For instance, if you're self-converting a commercial van into a campervan, it will likely begin its journey as a 'van under conversion'. Once the conversion is complete, you may need to change your vehicle's classification to 'motor caravan' and secure a suitable insurance policy.

Choosing the most suitable policy for your vehicle can be tricky, but Lifesure can help. Our dedicated self-converted campervan insurance can help protect your pride and joy with flexible cover to suit your specific requirements.

Find suitable cover for your van or campervan with specialist insurance from Lifesure

Now that you know the key differences between campervan and van insurance, you can arrange cover based on your personal requirements.

If you drive a commercial vehicle, van insurance can provide adequate coverage. However, if you're a campervan owner, arranging specialist insurance can offer added features to protect you and your belongings when on your adventures.

If you’d like to secure van or campervan cover based on your specific requirements, we can help.

At Lifesure, we have decades of experience in helping our customers find camper van insurance policies to suit their budgets and situations. Get a quote online or contact our team on 01480 402 460.

Disclaimer: The sole purpose of this article is to provide guidance on the issues covered. This article is not intended to give legal advice, and, accordingly, it should not be relied upon. It should not be regarded as a comprehensive statement of the law and/or market practice in this area. We make no claims as to the completeness or accuracy of the information contained herein or in the links which were live at the date of publication. You should not act upon (or should refrain from acting upon) information in this publication without first seeking specific legal and/or specialist advice. Arthur J. Gallagher Insurance Brokers Limited trading as Lifesure accepts no liability for any inaccuracy, omission or mistake in this publication, nor will we be responsible for any loss which may be suffered as a result of any person relying on the information contained herein.

FP1692-2025